Smartsheet: The Best Deal In The Software Sector (NYSE:SMAR)

Edwin Tan

As momentum for a year-end rally builds, investors should emphasize their stock selection on growth-oriented value stocks that have been severely beaten down this year. When growth kicks back into being “popular”, these beaten-down names that have plenty of valuation rope to climb have tremendous potential to beat the S&P 500.

Smartsheet (NYSE:SMAR), in my view, is an excellent stock that fits this bill. This enterprise software platform helps distributed teams collaborate and track project milestones, a well-established tool that has been deployed at over 90{f5ac61d6de3ce41dbc84aacfdb352f5c66627c6ee4a1c88b0642321258bd5462} of the Fortune 100 (including names like American Express (AXP) and Procter & Gamble (PG), among others).

Despite continued fundamental strength, Smartsheet has fallen tremendously this year on weakened sentiment. Instead of choosing to see Smartsheet for a relatively young company that is still growing and scaling, investors have sold off the company for its high GAAP losses. Year-to-date, the stock has lost 60{f5ac61d6de3ce41dbc84aacfdb352f5c66627c6ee4a1c88b0642321258bd5462} of its value:

My advice here: don’t forget the power of the software business model and why investors were so drawn to SaaS names prior to this year’s correction. Software companies invest tremendously into product development, sales, and marketing early on in their lifespans, splashing deep red ink onto the financials. Yet at high gross margins, and with sticky recurring revenue contracts that tend to grow over time as customers expand their purchases, software companies eventually mature into very profitable businesses – it just takes the foresight and willingness to look beyond the short term.

Due to Smartsheet’s continued slide despite strong fundamental performance, I’m upgrading my view on Smartsheet to very bullish. Don’t miss the opportunity to buy this stock at a very cheap price ahead of a potential year-end market rally.

For investors who are newer to this name, here are the key reasons to be bullish on Smartsheet:

- Remote work is going to continue being the “new normal”. Now realizing that productivity doesn’t suffer as much as originally thought when teams go remote, some companies are relaxing their expectations for employees to be fully back in the office even after the pandemic subsides. Some companies have even let their employees know it’s okay to work remotely indefinitely. But remote teams need a workspace to collaborate in, and tools like Smartsheet are perfect complements for that. This is especially true for distributed teams, where people are in different locations and some are in-person while others are remote: tools like Smartsheet help to rein in the geographic distance.

- High gross margins. Smartsheet’s 80{f5ac61d6de3ce41dbc84aacfdb352f5c66627c6ee4a1c88b0642321258bd5462}+ pro forma gross margins are among the highest in the software industry, and enable the company to achieve significant operating leverage as it scales.

- Smartsheet is moving to bigger and bigger deals, and expansion rates remain high. As Smartsheet has proven its utility and flexed its muscles as a more prominent public company, the company has been able to sign larger deals. In its most recent quarter, its count of >$100k ACV customers grew 74{f5ac61d6de3ce41dbc84aacfdb352f5c66627c6ee4a1c88b0642321258bd5462} y/y to more than 1k such customers. The average customer is also upgrading their relationship with Smartsheet: net revenue retention rates are clocking in around 130{f5ac61d6de3ce41dbc84aacfdb352f5c66627c6ee4a1c88b0642321258bd5462}, which exceeds most other SaaS stocks.

- Horizontal software and broad use cases. Smartsheet is broadly applicable to virtually any industry and virtually any team or function within a company, making its addressable market wide.

- Broadening its product platform. Smartsheet made its first major acquisition in 2020 of a company called Brandfolder, which helps companies manage and run analytics on their digital web content. In late 2021, the company also released a premium version of its product called Smartsheet Advance. Continued product rollouts could lead to expanding use cases and a larger TAM for Smartsheet.

And despite these strengths, Smartsheet’s YTD declines have rendered its stock at an incredibly attractive value. At current share prices near $31, Smartsheet trades at a market cap of $4.06 billion. After we net off the $446.7 million of cash on the company’s most recent balance sheet, the company’s resulting enterprise value is $3.61 billion.

For the current fiscal year FY23 (which for Smartsheet is the year ending in January 2023), Smartsheet has guided to revenue of $756-$761 million, representing 37-38{f5ac61d6de3ce41dbc84aacfdb352f5c66627c6ee4a1c88b0642321258bd5462} y/y growth, up slightly from a prior range of 36-37{f5ac61d6de3ce41dbc84aacfdb352f5c66627c6ee4a1c88b0642321258bd5462} y/y growth.

Smartsheet outlook (Smartsheet Q1 investor presentation)

Against the midpoint of this revenue outlook, Smartsheet trades at just 4.7x EV/FY23 revenue – which is an incredibly low multiple for a software company growing north of >40{f5ac61d6de3ce41dbc84aacfdb352f5c66627c6ee4a1c88b0642321258bd5462} y/y.

The bottom line here: There is a huge disconnect between Smartsheet’s fundamentals at its current trading levels. While it may take some time for sentiment to recover on Smartsheet, the company’s latest trend of beat-and-raise quarters should help lift investors’ spirits over time. Don’t pass up this rare, overlooked opportunity.

Q1 download

Let’s now go through Smartsheet’s latest quarterly results in greater detail. The Q1 earnings summary is shown below:

Smartsheet Q1 results (Smartsheet Q1 investor presentation)

Smartsheet’s revenue in Q1 grew 43{f5ac61d6de3ce41dbc84aacfdb352f5c66627c6ee4a1c88b0642321258bd5462} y/y to $168.3 million, beating Wall Street’s expectations of $162.5 million (+39{f5ac61d6de3ce41dbc84aacfdb352f5c66627c6ee4a1c88b0642321258bd5462} y/y) by a four-point margin. Revenue growth also kept the exact same pace as last quarter’s 43{f5ac61d6de3ce41dbc84aacfdb352f5c66627c6ee4a1c88b0642321258bd5462} y/y growth rate.

Now, one potential yellow flag for Smartsheet’s growth trajectory is billings. As software investors are aware, billings represent a better indicator of a company’s longer-term growth potential than revenue, as it captures deals signed in the quarter that won’t be recognized as revenue until future quarters. In Q1, Smartsheet’s billings grew 36{f5ac61d6de3ce41dbc84aacfdb352f5c66627c6ee4a1c88b0642321258bd5462} y/y, decelerating from the mid-high 40s in the past few quarters. There could be an element of timing and linearity here, however, as Smartsheet had a very strong Q4 billings quarter in which billings growth exceeded revenue growth by five points.

Smartsheet Q1 billings (Smartsheet Q1 investor presentation)

Smartsheet has noted that so far, it has not seen any tighter macro conditions impacting its sales execution. This does stand in contrast versus many other enterprise tech companies, some of which have reported lengthening deal cycles as companies pull back spending in anticipation of a recession.

Here’s some qualitative commentary on the company’s go-to-market results from CEO Mark Mader’s prepared remarks on the Q1 earnings call:

We continue to see success on each of the land, expand, and climb aspects of our go-to-market motion. On the land dimension, our previously discussed investments in simplifying packaging and the onboarding process are paying off.

Q1 was a record quarter for new customer bookings and the highest net logo growth we’ve experienced since our IPO. On both land and expand dimensions, the net new plans added in Q1 increased by more than 4 times versus Q1 of last year. And on the climb dimension, we saw 57 domains expand their Smartsheet investment by $100,000 or more in Q1, up 97{f5ac61d6de3ce41dbc84aacfdb352f5c66627c6ee4a1c88b0642321258bd5462} year-over-year, including an expansion of over $1 million.

Additionally, we saw our churn rate in Q1 improved to a record low of 4{f5ac61d6de3ce41dbc84aacfdb352f5c66627c6ee4a1c88b0642321258bd5462} and we finished the quarter with more than 10.5 million Smartsheet users. We now have 33 customers with ARR over $1 million and three customers that have over 125,000 Smartsheet users. Smartsheet continues to provide the best-in-class value in the category as our collaborator model allows Smartsheet to achieve broad reach in a way that is both frictionless for the user and cost advantageous for the customer.”

The company noted as well that employee attrition was low. In addition, the company hit its sales hiring targets and welcomed its largest class of new salespeople in its history, while also promoting high-performing quota-carrying reps to manager positions – moves that the company believes will help sales momentum in FY23.

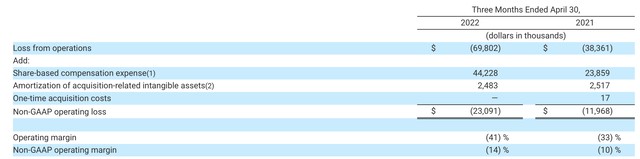

Investments in growth have prompted a slight pullback in operating margins, which fell four points to -14{f5ac61d6de3ce41dbc84aacfdb352f5c66627c6ee4a1c88b0642321258bd5462} in the quarter:

Smartsheet margins (Smartsheet Q1 investor presentation)

However, I’ll continue to emphasize that with 80{f5ac61d6de3ce41dbc84aacfdb352f5c66627c6ee4a1c88b0642321258bd5462}+ gross margins and revenue/billings growth in the ~40{f5ac61d6de3ce41dbc84aacfdb352f5c66627c6ee4a1c88b0642321258bd5462} range, Smartsheet still has incredible potential for scalability down the road.

Key takeaways

Smartsheet is a heavily overlooked software stock that has a well-recognized, best-in-class product on top of solid financials and a strong track record for execution. Don’t miss the chance to buy this fantastic growth name at <5x forward revenue (and recall that not too long ago, companies in Smartsheet’s growth range were trading at low-teens multiples of revenue).