Computer Services Stock: Time To Buy The Tiny Dividend King (OTCMKTS:CSVI)

gorodenkoff

Laptop Solutions, Inc. (OTCQX:CSVI) just just lately joined the dividend kings, a group of companies getting 50 or a lot more yrs of consecutive dividend boosts.

At first look, Pc Products and services appears to be an unlikely prospect to be a king of something. It is a smaller cap that trades in excess of the counter. It is not a member of the S&P 500, so it is not a Dividend Aristocrat. But it has increased dividends via eight recessions. In addition, the business lately reported:

- 22 consecutive decades of income expansion

- 25 yrs of web cash flow advancement

- 50 decades of dividend growth

Business

CSVI has supplied personal computer solutions to consumers from the commencing of its record. The organization opened its doorways in 1965 with 6 staff, 3 shoppers, and a $321,400 Burroughs B300 pc. The personal computer sorted checks and deposit slips printed with MICR figures at a level of 1,500 items for each minute.

The enterprise reorganized into two functioning segments in 2020.

The core banking products and services are in the Organization Banking Team. This involves payment methods as properly as cellular and web banking.

The Enterprise Remedies Group handles a myriad of expert services together with:

- Doc options: test imaging, branch and service provider seize, several document delivery solutions

- Managed solutions: cyber protection, community management, cloud-centered management providers, company intranets, telecommunication, remote banking connectivity, website web hosting, board portals, computer software licensing and set up, and skilled products and services

- Regulatory Compliance: compliance software, homeland protection, anti-cash laundering, anti-terrorism funding, and fraud prevention

A detailed list of the company’s intensive expert services can be discovered in the company’s supplemental disclosures to the once-a-year report.

The money companies market is subject to comprehensive govt rules. This delivers a moat for the organization fairly than a threat. The business gets to be the qualified in conference regulations and codes the know-how into its software program for all its shoppers. Other providers would require to do sizeable do the job to match this understanding and integrate it into the computer software.

Software program will have to be accurate, but it also need to be usable. Laptop or computer Solutions was regarded by Aite Team as offering the “finest consumer encounter” in its 2019 Purpose Evaluation. A single report wrote,

it can be no surprise they received the award. CSI’s successful and transparent administration staff, in conjunction with their substantial retention prices are the major reasons for this achievement.

Tim Viere, CEO of EntreBank reported of deciding upon Laptop Solutions,

In every single evaluate, CSI rose to the leading as the very best banking products and services provider that could supply the modern technologies progress and client provider we needed to provide that price for our buyers.

In 2019, the organization has been acknowledged as 1 of Finest Spots to Do the job for seven consecutive yrs by the Kentucky Chamber of Commerce and the Kentucky Society for Human Resource Management. The enterprise was once again named 1 of the Ideal Destinations to Operate in Kentucky in 2022, creating the record for 10 consecutive yrs. The business was also acknowledged to be a best spot to work in Illinois. The business has a honest ranking of 3.7 at Glassdoor.

The directors and executive officers together have 2.22{f5ac61d6de3ce41dbc84aacfdb352f5c66627c6ee4a1c88b0642321258bd5462} of shares.

As of this creating, the dividend sits at a shade higher than 3{f5ac61d6de3ce41dbc84aacfdb352f5c66627c6ee4a1c88b0642321258bd5462}.

Valuation

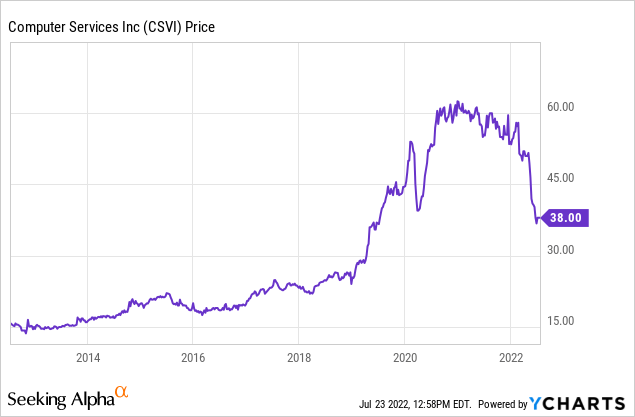

The company’s stock value extra than doubled in 2019, plummeted for the duration of the pandemic in 2020, than rose nonetheless a lot more in a V-shaped restoration. Considering that mid 2020, however, the inventory price has drifted downwards. In the last 6 months it repeated the swan dive that it did all through the pandemic. The stock selling price is presently at pandemic lows:

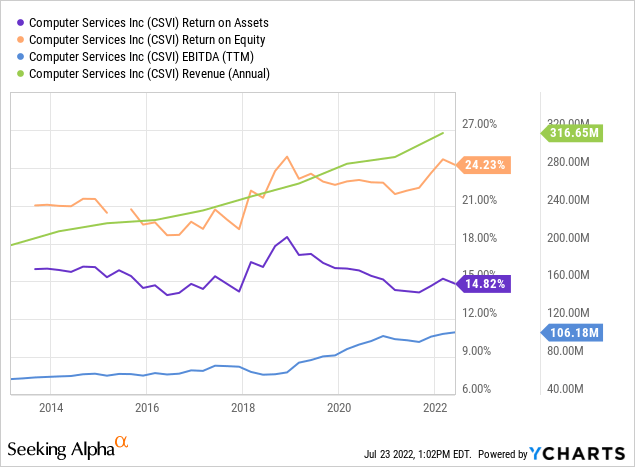

This is the very same organization that has been increasing income, earnings, and ROA steadily for yrs:

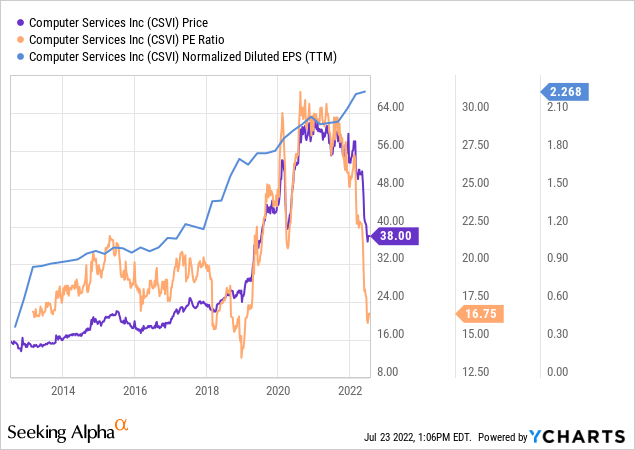

It should not be shocking that the P/E for the firm is now at a reduced not seen since 2019, a reduced noticed only a few instances in the previous decade:

Feasible Risks

The most important possibility at current is that the inventory cost will continue to plummet. It is pretty much a quintessential illustration of a falling knife. It is generally not a great plan to attempt to capture 1.

In addition, the stock is modest and does not trade on major exchanges. This sort of stocks are typically a lot more unstable and dangerous than other shares.

Continue to keep in brain, though, that this is not a common compact cap business. Its steadiness is simple to see. The organization is not in jeopardy in any way.

Nor is the dividend at hazard. The company sports activities a Current Ratio of 2.48 and a Fast Ratio of 1.88. These numbers have not improved considerably around the years. It is really hard to visualize a dividend king discontinue dividend increases immediately after 50 decades.

The major issue may possibly be just be that its whole return over the extended time period is lower than advancement traders usually like to see. The latest drop in stock selling price could possibly perfectly compensate handsomely for that. I myself created a good little bit of revenue from the stock’s restoration from pandemic lows. I assume I will all over again see a awesome return from this small, even if the increase in stock price is not as extraordinary as it was two years back.

Conclusions

Laptop Services is as good a enterprise that can be discovered anywhere, obtaining amplified its revenue, net profits, and dividends in fantastic occasions and lousy. It has survived pretty effectively in previous recessions, and it should do just wonderful in the future a single. Its software has received at the very least a single award, and the business has obtained see as a fantastic spot to operate in both of those Kentucky and Illinois.

The income progress ought to proceed, bit by bit and steadily. The stock cost must resume its upward climb sooner or later on. The reduced it drops, the far more spectacular the restoration really should be.

I have not too long ago bought shares at $38.27 for my portfolios, to exchange the kinds I offered off some months in the past. I intend to dollar ordinary supplemental positions in coming months.