Will plunging shares end big tech’s era of ‘pornographic’ profits? | Technology

Last 7 days was a poor time to be a tech billionaire. When the pandemic drove the earth online, the founders of Facebook, Google and Microsoft reaped prosperity gains explained as “pornographic” and cemented their place as between the richest cohort at any time to have trod the world. Perfectly, the “good times” are about. Type of.

The world’s major tech firms noted their most current earnings previous week and, for most, the information was terrible. Meta (previously Facebook), Alphabet (previously Google) and Microsoft saw billions wiped off their values as investors commenced to be concerned that the best times of the tech titans were driving them. As buyers made for the exit, the 5 greatest tech shares crashed by a blended $950bn (£820m) at their least expensive position. The slide also hit the fortunes of their creators.

Fb co-founder Mark Zuckerberg’s fortune plunged by $11bn on Wednesday immediately after Meta Platforms claimed a next straight quarter of disappointing earnings. Shares in the enterprise dropped by a fifth – a sharp depreciation that has introduced Zuckerberg’s overall drop in prosperity this calendar year to more than $87bn. The quantities could be no a lot more than arithmetically diverting – Zuckerberg, 38, is even now well worth about $38bn, in accordance to Bloomberg – but that is a hanging fall on the $142bn he could depend on in September 2021. Practically all of his prosperity is tied up in Meta stock he retains far more than 350m shares. As of Thursday, Zuckerberg rated 28th on the Bloomberg listing, a 25-area fall from his past 3rd-spot positioning.

Meta’s 71{f5ac61d6de3ce41dbc84aacfdb352f5c66627c6ee4a1c88b0642321258bd5462} slide in benefit this yr is owing to a lot of matters, like advert-monitoring controls instituted by Apple, a softening in digital advert paying, the obstacle to Facebook-owned Instagram by TikTok, and Meta’s multibillion-dollar expense in the metaverse – the digital globe it is throwing funds at irrespective of a much less-than-warm reception, even from its possess personnel.

That financial commitment has troubled investors. Zuckerberg has explained he expects the venture to shed “significant” quantities of revenue more than the up coming a few to five a long time. On Wednesday, he asked for patience.

“I imagine we’re heading to resolve each of these things in excess of unique intervals of time,” Zuckerberg explained. “And I recognize the patience, and I consider that these who are patient and commit with us will conclude up getting rewarded.” Wall Avenue appears rather out of persistence.

The CNBC Television set presenter Jim Cramer, who has been a booster for Meta, looked near to tears following the most recent success had been introduced. “I produced a miscalculation below,” Cramer explained to viewers. “I was erroneous. I trusted this administration crew. That was ill-advised. The hubris listed here is extraordinary and I apologise.”

Zuckerberg is not on your own. In accordance to Forbes, the tech billionaires have lost a collective $315bn considering the fact that very last year.

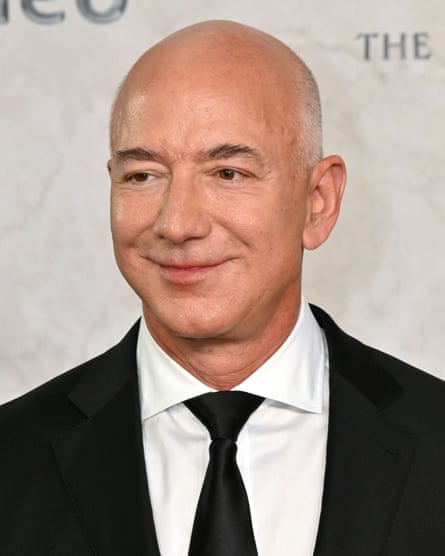

On Thursday, Amazon documented that this Xmas season would be less jolly than analysts experienced anticipated and that consumer expending was in “uncharted waters”, triggering a 20{f5ac61d6de3ce41dbc84aacfdb352f5c66627c6ee4a1c88b0642321258bd5462} drop in its share rate. The decrease hit Amazon founder Jeff Bezos by as considerably as $4.7bn on the day. Bezos had by now misplaced nearly $60bn in 2022, however leaving him with a internet value of about $134bn.

A day previously, Microsoft’s earnings report confirmed that the reliable cloud-computing earnings expansion at its Azure division was slowing, triggering a practically 8{f5ac61d6de3ce41dbc84aacfdb352f5c66627c6ee4a1c88b0642321258bd5462} decrease in the company’s valuation. That will strike Monthly bill Gates, whose fortune has declined this yr by close to $30bn to about $109bn.

Even Tesla founder Elon Musk, the world’s richest gentleman and now the owner of Twitter, has not been immune to the downturn. Shares in Tesla, the electric powered automobile maker, have fallen 43.7{f5ac61d6de3ce41dbc84aacfdb352f5c66627c6ee4a1c88b0642321258bd5462} in the 12 months to date. That is decreased the would-be Mars coloniser’s fortune by $58.6bn over the previous 12 months to a still astronomical $212bn.

But despite the week’s inventory industry bloodshed, 56 of the 65 tech billionaires on Forbes magazine’s record – a single that consists of Oracle founder Larry Ellison, Google founders Larry Web site and Sergey Brin, Twitter founder Jack Dorsey, and previous Microsoft main govt Steve Ballmer – are nonetheless wealthier than they were being 3 several years ago.

Before this calendar year, Chuck Collins, the director at the Institute for Policy Studies thinktank who directs its programme on inequality, approximated that US billionaires had witnessed their blended wealth increase far more than $1.7tn, a obtain of much more than 58{f5ac61d6de3ce41dbc84aacfdb352f5c66627c6ee4a1c88b0642321258bd5462}, in the pandemic. The recent declines have, Collins now states, lowered that to $1.5bn, or 51{f5ac61d6de3ce41dbc84aacfdb352f5c66627c6ee4a1c88b0642321258bd5462}.

“The gains ended up so remarkable in the two a long time of the pandemic, it was nearly pornographic,” he said. “The billionaires effectively disconnected from the authentic environment and the actual financial state. Even if their wealth is now altering down, who else had a 51{f5ac61d6de3ce41dbc84aacfdb352f5c66627c6ee4a1c88b0642321258bd5462} obtain in their property in the earlier two several years?”

The billionaires are not the serious victims. Tech corporations have come to dominate US inventory marketplaces and their decline is dragging down the wider market place, and with it the pensions and personal savings of People in america who are also having difficulties with climbing curiosity premiums and a 40-calendar year large in inflation.

The bigger query is: how lengthy will this slide go on, and who will be damage the most? It is not likely to be significant tech’s aristocrats. “If wealth is likely to vanish from the economic climate, this is the best place for it to vanish from,” Collins states. “It may possibly sluggish the trickle into philanthropy, but the fact is most billionaires are providing to their own foundations and donor-suggested funds. But it could indicate there is fewer dynastic wealth, which in the finish I assume is a excellent factor.”