The 10 Best Accounting Software of 2022

Who utilizes accounting program?

I’d like to say that any individual in company uses accounting program, but unfortunately, that is not the case. On the other hand, everyone in small business really should use accounting software package. That consists of the contractor you hired to create a push launch, the property management company that you fork out your rent to each and every month, your property finance loan holder, your health care provider, and your legal professional. Absolutely everyone who is in small business should really be utilizing some variety of accounting program considering the fact that it is impossible to evaluate their company’s monetary wellness with out it.

Why use accounting software program?

Wise organization proprietors use accounting program for a selection of good reasons. Some use it since it simplifies the overall report-maintaining approach. Entering a purchaser into a computer software application and making an bill is substantially a lot easier than entering that same details into a spreadsheet, and then acquiring to generate an invoice in a different application. Some others use it because they want to know how significantly revenue they’re making, or in some instances, not producing. Continue to other people use it to retain a far better tackle on their business price groups.

How will you know how nutritious your organization is if you have no thought who owes you dollars or how a lot income you have spent in the last 6 months? How will you influence a lender to give you a credit score line if you are unable to present them that your business is monetarily nutritious? Possibly most critical, how will you continue to keep keep track of of your numerous tax obligations if you are not adequately tracking product sales tax, use tax, work tax, and personnel withholding tax?

Underneath are some of the positive aspects of utilizing accounting software.

You can usually know the monetary standing of your company

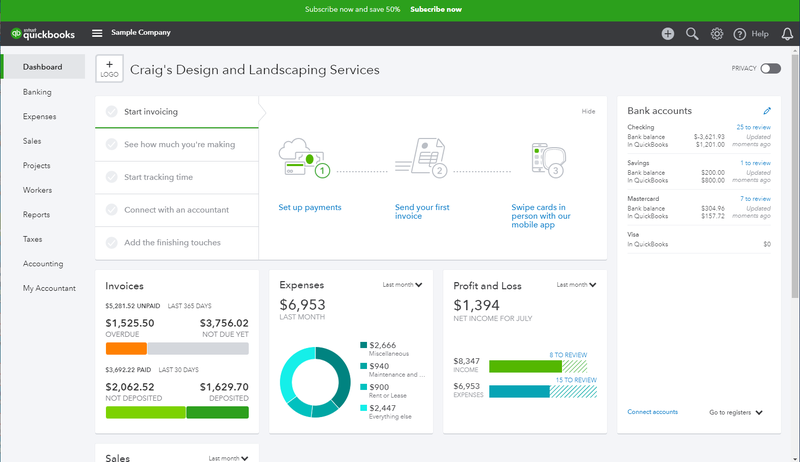

Instead of consulting many data files to see how much you’re paying out, how much you’ve got been paid, or how substantially is still owed, you can watch all this data from 1 central dashboard.

This dashboard view from QuickBooks On the net (higher than) gives you the information and facts you will need in just one handy place, together with compensated and exceptional invoices, the place you have invested your funds, and even the present-day balances of your bank accounts. So, cease seeking at multiple spreadsheets and start out utilizing accounting software.

It really is a more rapidly way to get paid

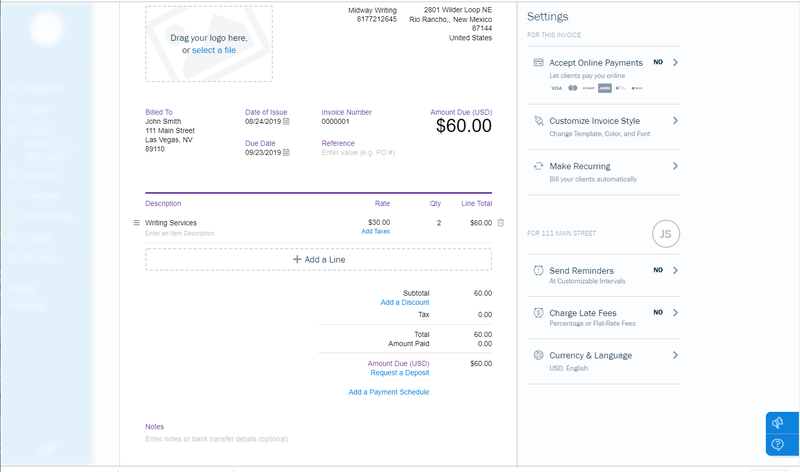

We all want to get paid, normally, you will find genuinely no motive to be in business enterprise. But 1 of the methods to get paid out quicker is to make it effortless for your buyers to pay out you. Accounting software program aids with every thing from such as payment hyperlinks in invoices, accepting electronic payments by your financial institution, to accepting credit history playing cards by way of a merchant account (see image down below). Creating it a lot easier for them to shell out a invoice will likely suggest that they will pay you quicker, or at the incredibly minimum, on time.

Taxes, taxes, taxes

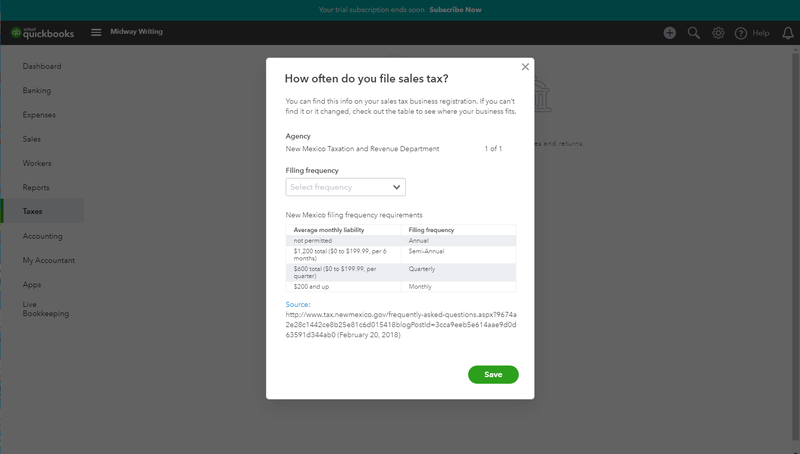

If you use accounting software for nearly anything, use it to keep on being tax compliant. If you sell something, you will owe taxes. If you pay staff, you will owe taxes. If you are living in a significant, metropolitan space, or provide in several states, you will owe taxes to numerous diverse companies.

As the QuickBooks On-line display (over) asks, how frequently do you file revenue tax? Employing the correct accounting program will permit you to keep on being compliant with all tax organizations. You’ll be able to demand your buyers the suitable tax charge though also working reviews that clearly show how a lot tax is owed to each and every tax agency.

If you have personnel, you will have payroll taxes that need to have to be compensated on time these kinds of as federal withholding, condition withholding, Social Safety and Medicare taxes, and unemployment taxes. Enable your accounting application do the heavy lifting and present you with the applications you need to normally be compliant.

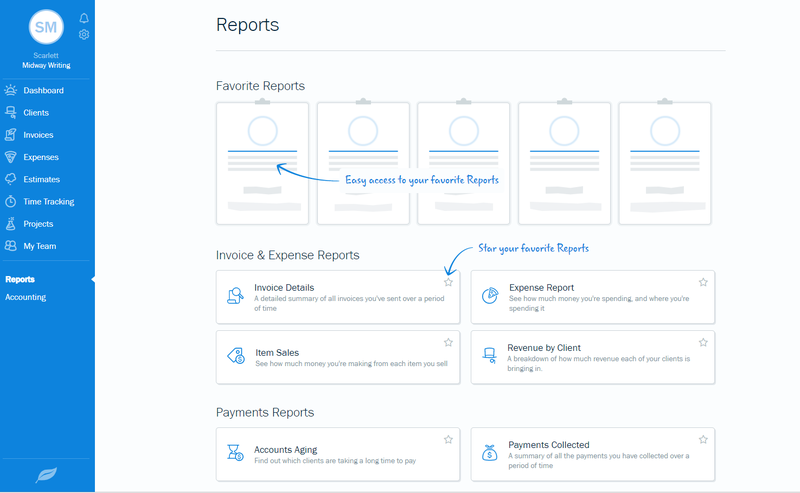

Your stories are correct

Transposition glitches, further decimals, decimals in the wrong put, added zeros, not ample zeros these are all things that can occur when you use spreadsheet packages to build studies manually. Skillfully prepared reviews give your organization believability. When you use accounting software, your stories are ready applying info you have currently entered into the process. If that data is exact, so are your stories (see impression underneath).

Microsoft Excel enthusiasts should not truly feel too bad. Most accounting computer software programs permit you to export your experiences to Excel, where you can customise them if you wish the variation currently being that you are setting up with the accurate figures.

What are the distinct forms of accounting computer software?

There are three styles of accounting application purposes that are normally utilised.

- Business accounting software program: This ranges from uncomplicated apps that supply bare-bones features to whole-support apps that provide full accounting features. There are also a variety of add-on modules to decide on from. Professional software program is ordinarily out there as a downloadable application. It applied to be put in from a CD-ROM, but most business accounting software program is now downloaded from the software vendor and installed on a desktop or workstation laptop. It can also be delivered by way of subscription as SaaS (Computer software as a Support) or from the cloud.

- Organization source scheduling (ERP) software package: This is normally only applied by the quite most significant companies. ERP software program is notoriously costly, and unless of course you might be a billion-greenback company, it is probably substantially extra than you will ever need to have.

- Custom accounting software program programs: These were being preferred about 20 a long time ago, but have generally disappeared from offices merely mainly because of the scope of attributes now observed in business accounting computer software. Tailor made deals can also confirm to be much more difficulty than they’re truly worth and normally you should not integrate with any other programs.

Critical accounting program functionality

Accounting computer software purposes need to present most, if not all, of the next options.

Main accounting features:

- Double-entry accounting

- Invoicing (A/R)

- Invoice payment (A/P)

- Shopper & vendor management

- Banking

- Budgeting

- Administration reporting

Further modules:

- Inventory administration

- Invest in orders

- Payroll

- Revenue / position-of-sale

You may possibly not get each individual module in each item, but you should really get the modules that are vital for you to run your small business.

What to take into consideration when getting accounting computer software

What capabilities are most important for your enterprise?

Is quick invoice generation significant to you? Then you require an application that tends to make developing an invoice brief and painless. Do you give a selection of merchandise to your customers? If so, you have to have a way to manage your stock thoroughly. What about banking? Do you normally overlook to report your bills when you use your credit score card? If that is you, then you’ll want an software that will import all of your banking transactions, and history them to the correct expenditure account.

If you have personnel, you want a way to fork out them, as very well as a way to make guaranteed that your tax obligations are taken care of. Even though most accounting software package does several, if not all, of these things, you will need to decide what features are a should-have, and glance accordingly.

Your budget

When it truly is important to purchase the accounting application that will operate most effective for you, your organization’s funds factors can also enjoy a part in your last conclusion. If you might be a sole proprietor or freelancer on a very strict spending budget, you may possibly have to choose from the purposes that are in just your get to. But really do not panic, several of the finest applications readily available nowadays are under $25 for each month.

Your business market

The type of company you operate may perhaps play as significantly of a part in your ultimate selection as charge and features. If you sell hair solutions on line, you will have diverse needs than a graphic artist that offers a layout company. But what if you market products and providers? Straightforward. Just make sure that the product you purchase is suited to equally.

Guidance

While most people will not assume about guidance when comparing accounting purposes, you may possibly want to commit a number of minutes hunting at the readily available assistance options. I assure that very little will be more frustrating that trying to figure out the reply to a issue with no a good assist composition in location. Knowledgebases are terrific, but they are no substitute for an precise human getting.