Britain’s future technology winners – Investors’ Chronicle

- Internet asset benefit per share rises 27 for each cent to £48.7mn (88.5p a share)

- Yearly pre-tax profit of £10.9mn in 12 months to 30 June 2022

- Fair price of equity portfolio boosts 24 per cent to £39.7mn

- Hard cash balance of £4.4mn boosted write-up calendar year-conclude

Edinburgh-based Frontier IP (FIPP:67p), a technology expenditure corporation that gives commercialisation services to college spin-outs in return for ‘free equity’ stakes, has sent an additional spectacular year of progress, buoyed by £10.9mn of unrealised gains and a realised earnings of £2.9mn on the £6.5mn section disposal of its holding in Nasdaq-stated Exscientia (US:EXAI), a scientific-stage pharma know-how business revolutionary the use of AI to layout new medicine.

Since the economical yr-conclusion, Frontier has offered a further £3.4mn of shares in Exscientia to lift its pro-forma income pile to £7.7mn (14p a share). This suggests the corporation has realised just about £10mn of dollars proceeds from an expenditure that initially expense £2,000 and nevertheless retains a stake value £5mn. Importantly, Exscientia is not only nicely capitalised, owning additional than $730mn (£652mn) of equilibrium sheet money, but has forged vital partnerships with some of the world’s greatest pharmaceutical companies, like Bristol Myers Squibb and Sanofi, and establishments such as the Bill & Melinda Gates Basis. The College of Dundee spin-out has probable to experience $5.2bn of milestones and royalties from these partnerships, also.

By realising funds from Exscentia – the holding now only accounts for 10 per cent of Frontier’s web asset benefit (NAV) of £48.7mn – Frontier’s administration has sensibly minimized portfolio concentration threat as nicely as constructing up a cash pile which can be made use of to further diversify the portfolio.

Frontier’s most significant financial commitment is now an 18.3 per cent stake in College of Plymouth spin-out Pulsiv Solar. Following the first shut of the company’s new funding round over the summer time, the holding was revalued upwards from £5mn to £9.1mn, accounting for 19 for each cent of Frontier’s NAV of £48.7mn. There could be materially far more financial commitment upside to come.

That is simply because Pulsiv has created patented technological know-how that improves the electricity effectiveness of electrical power converters in a broad array of every day products and solutions these types of as battery chargers, lights apps, electrical autos, moveable energy resources and DC motors. About fifty percent the energy utilized by equipment is wasted due to inefficient power conversion – that’s why converters heat up in operation. Having said that, Pulsiv’s patented know-how converts electrical energy a great deal far more effectively – in exams it wastes only about 10 for every cent of the electricity – so it could significantly lower the strain on nationwide electricity grids if adopted on a massive enough scale whilst also lowering expenditures for buyers. Pulsiv is in superior conversations with important brands and has signed a strategic distribution agreement with Astute Electronics and a world-wide distribution settlement with Digikey Electronics, the world’s fifth premier digital components distributor. The company is also working with German engineering big Bosch to optimisr the design of an strength-successful photo voltaic microinverter prototype for mass manufacture.

Frontier also booked a £1mn unrealised attain on its 17 for every cent stake in The Vaccine Group (TVG), a organization that is making a vast vary of vaccines primarily based on a novel herpesvirus-dependent platform with a main focus on preventing the unfold of zoonotic and economically harmful ailments. TVG accomplished a key milestone in the development of its following era Covid-19 vaccine for use in animals. Especially, trial knowledge from pigs confirmed powerful T mobile responses to SARS-CoV-2, the virus that triggers Covid-19, as effectively as the a lot more divergent SARS-CoV-1. This means the vaccine has the possible to supply wide immunity towards present-day and upcoming variants.

Other vaccines beneath growth consist of all those for African swine fever, bovine tuberculosis, bovine mastitis, streptococcus suis, Ebola and Lassa fever. To date, TVG and its global companions have been awarded additional than £9mn in grant funding from the Uk, US and Chinese governments. Frontier’s stake in TVG is now valued at £5.5mn, or 11 for each cent of NAV.

It’s truly worth flagging up a few of the hidden gems in Frontier’s portfolio of 24 equity investments together with College of Central Lancashire spin-out Alusid and Cambridge College spin-out, CamGraPhIC.

Alusid has developed impressive formulations to build premium-high quality tiles by recycling industrial squander ceramics and glass, most of which would be otherwise sent to substantial-influence landfill. Alusid’s sustainable approach technologies employs up to 35 for every cent significantly less strength and 75 for every cent much less drinking water than common tile manufacture though however operating on the very same machines, decreasing CO2 emissions. The business has previously signed a industrial settlement to supply a big tile retailer.

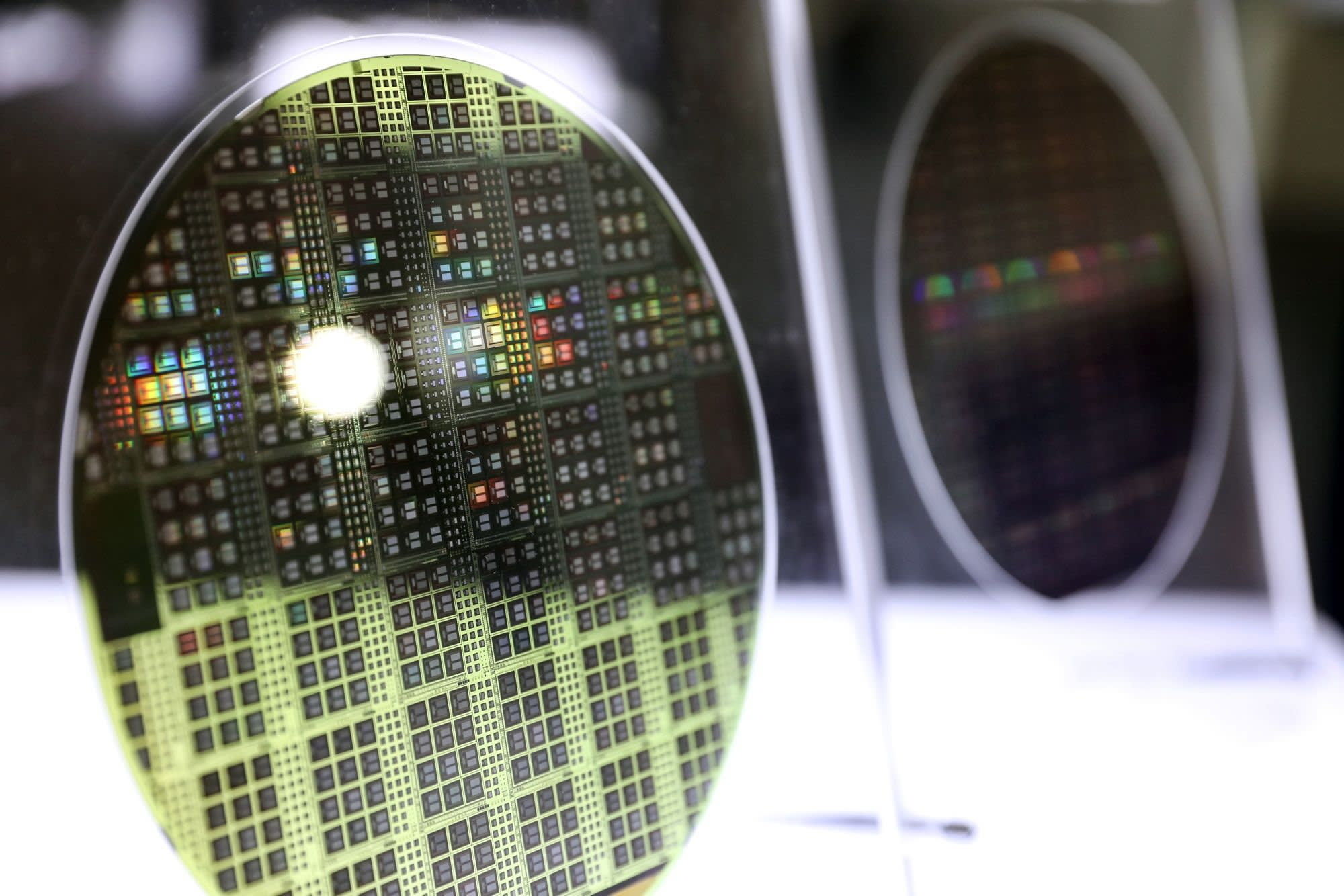

CamGraPhIC is building graphene-based mostly photonics technologies for scalable optical transceivers, products at the heart of high-velocity info and telecommunications networks which could grow to be a core enabling technology for 5G networks. In laboratory ailments, the technological know-how has operated at speeds twice that accomplished by current systems, and utilizes 70 for each cent less power, much too. CamGraPhIC has attracted fascination from big multinationals in the chip and telecoms sectors, and from traders who not long ago backed a £1.3mn funding round.

Investing in line with my previous acquire contact (‘A British know-how winner’, 8 August 2022) and 19 for every cent previously mentioned my 56.5p entry stage (Alpha Research: ‘A differentiated IP play’, 15 November 2019), the 24 per cent share price tag price cut to NAV is a harsh ranking in light-weight of management’s track history and the probable for further expense gains and realisations from the nicely-funded company’s portfolio. Purchase.

■ Simon Thompson’s most up-to-date book Successful Stock Picking Methods and his prior book Inventory Choosing for Gain can be purchased online at www.ypdbooks.com at £16.95 each additionally £3.95 postage and packaging. Facts of the content material can be considered on www.ypdbooks.com.

Marketing: Subject to inventory availability, both publications can be purchased for £25 plus £5.75 postage and packaging.