Best Time To Invest In Software In Years (NASDAQ:WCLD)

Jay Yuno/E+ via Getty Images

In this article, I present arguments for allocating capital to a particular slice of the tech sector that presents an extraordinarily rare opportunity for long-term compounding potential: Software.

In my view, this period presents one of the best times in the last decade to invest in public equity software. I make the case for this with industry dynamics, the interplay of macro and costs of capital, and valuation paradigms marked by historical data.

The Recent Fall of Software

Macroeconomic fears, inflation, and geopolitics have led to a broad risk-off environment that came into investors’ periscope in late 2021, and then subsequently picked up speed with the onset of higher-than-expected inflation paired with the Russia-Ukraine war. Food and oil prices, higher rates to combat inflation, we all know the story.

As software companies by and large have a mix of growth-oriented forecasts, free cash flows late into the future, and valuations built on long-duration rather than short-duration financials, these businesses logically sold off.

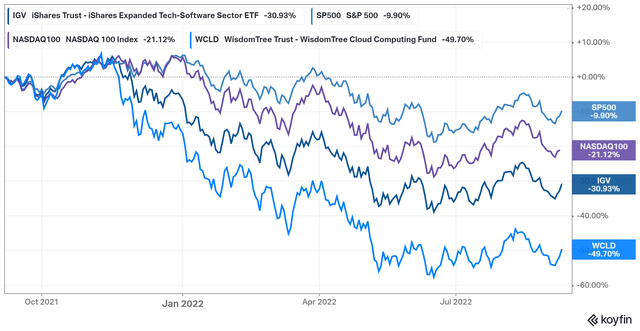

WisdomTree Cloud ETF vs benchmarks (Koyfin)

The chart above shows two prominent software ETFs:

- IGV – iShares Expanded Tech-Software ETF

- WCLD – WisdomTree Cloud Computing ETF

IGV holds some GARP=oriented names, while WCLD is more high-growth influenced in its composition. Naturally, both have underperformed the S&P and Nasdaq with WCLD scoring a rather nasty 50{f5ac61d6de3ce41dbc84aacfdb352f5c66627c6ee4a1c88b0642321258bd5462} drawdown from late 2021. For those investors following this space, you’d have noticed 50-70{f5ac61d6de3ce41dbc84aacfdb352f5c66627c6ee4a1c88b0642321258bd5462} drawdowns in high-flying names that are now being judged for their profitability rather than their growth.

The valuation story, of course, builds on the cost of capital. As interest rates have risen, so have 10-yr treasury yields to the tune of 3.5{f5ac61d6de3ce41dbc84aacfdb352f5c66627c6ee4a1c88b0642321258bd5462} and counting on their trend to perhaps 4{f5ac61d6de3ce41dbc84aacfdb352f5c66627c6ee4a1c88b0642321258bd5462} or worse if needed in this macro environment. By financial theory, this drastically influences discounted cash flow models bringing in “intrinsic valuations” lower. A rule of thumb to follow here is that with every 1{f5ac61d6de3ce41dbc84aacfdb352f5c66627c6ee4a1c88b0642321258bd5462} point increase in the 10-yr yield, valuations in the high-growth category decline 20{f5ac61d6de3ce41dbc84aacfdb352f5c66627c6ee4a1c88b0642321258bd5462} on an intrinsic basis. 3 percentage points result in a 49{f5ac61d6de3ce41dbc84aacfdb352f5c66627c6ee4a1c88b0642321258bd5462} drawdown.

Whether one agrees with modern financial theory and these methods of valuation may be somewhat irrelevant in a practical sense, as pension funds and institutional capital utilize these theories and vote with their capital. Thus the tech sector rotation and the software implosion.

But here’s the funny thing. Fundamentally, a lot of software businesses, particularly in the cloud computing space, are going seriously strong.

What We Learned Over The Last Two Quarters

We have two-quarters of earnings data and transcripts for 2021 across almost all software companies as I write this. Within my space of coverage, I’ve noticed certain patterns. There have been losers, certainly, that have seen decelerating growth with not-great profitability to show for it (TWLO, ZM), but they’ve also been winners that are executing on macro-resilience with mild or no effective macro headwinds.

The following earnings transcript excerpts provide a sense of the industry from software businesses operating in different domains.

- Microsoft – the big daddy of software

- HubSpot – a now large cap, marketing and CRM platform

- Alteryx – mid-cap, data analytics software

- Monday – mid-cap, a platform for workflow management and use cases

- Snowflake – large-cap, hyper-growth data warehousing

1. Microsoft

But what’s happening with — in Azure though, is in some sense, businesses trying to deal with the overall macroeconomic situation and doing — trying to make sure that they can do more with less. So for example, moving to the cloud is the best way to shape your spend with demand uncertainty, right? Because — and in fact, if anything, one of the things that we’re seeing is an increased shift towards the cloud.

And then, of course, optimizing your bill. We are incenting even our own field to ensure that the bills for our customers come down. And that, in fact, even shows up in some of the volatility in our Azure numbers because that’s one of the big benefits of the public cloud. And that’s why I think coming out of this macroeconomic crisis, the public cloud will be even a bigger winner because it does act as that deflationary force.

– CEO Satya Nadella – Q2 Microsoft (MSFT) Earnings Transcript

2. HubSpot

Now while these trends will have impact in the short term, and it is reflected within our guidance, we are confident in HubSpot’s long-term growth opportunity for a couple of reasons. First off, while these deals are taking longer, they are coming down to platform and multi-hub decisions. SMBs are figuring out how to spend effectively, and they’re looking at HubSpot as the platform to run their front office. So we see deals close favorably but taking a little bit longer. And second, we’re not a discretionary point solution.

We’re the backbone for small and medium businesses. All these businesses still need to market, they need to sell, they need to service their customers. And HubSpot is a system of [indiscernible] and engagement for customer data. So we’re mission-critical and we’re sticky. So while we’re seeing the demand trend soften a bit in the short term, we are very confident in our strategy and long-term growth.

– CEO Yamini Rangan, Q2 HubSpot (HUBS) Earnings Transcript

3. Alteryx

Business leaders are prioritizing analytics and embracing democratization of data to scale their analytics and upskill their workforces. And with the macro environment serving as a forcing function for businesses to optimize and automate analytics, the market is coming to us with greater urgency and demanding solutions that Alteryx is uniquely positioned to provide.

– CEO Mark Anderson, Alteryx Q2 Earnings Transcript

4. monday.com

Also in regard to your question about consolidation, I think that — in addition to what Eliran said with the macro economy, — we see here a great opportunity for us as a company because a lot of our customers realize that they can do much more with monday as a platform. They might have several use cases, but now they see the potential of the spend on monday throughout many more departments and perhaps consolidate a few different tools under monday. So definitely, we’re starting to see this as a trend. So that’s also very interesting. It’s something we also push in given the macro economy.

– Co-CEO Eran Zinman, Q2 monday.com Earnings Transcript

5. Snowflake

Last quarter, we called out customers that were negatively impacted by headwinds specific to their businesses. The Q2 results from these customers were mixed. Some saw the weakness we expected while others outperformed. We are monitoring our key business metrics, which we believe are leading indicators of the macro economy impacting our business. We are not seeing these metrics soften across the customer base…

Just a quick follow-up. I actually think that the dynamic that you’re describing, I mean, we’re going to see the exact opposite of that. We think people — because of the nervousness that they may have about the macro, they’re going to accelerate to a cloud computing platform. And the reason is these are elastic models. These are consumption models, right?

– CEO Frank Slootman, Snowflake Q2 Earnings Transcript

I haven’t included the most macro-resilient sector, cybersecurity among these companies. Those names have all sailed through with minimal interference. But there are a few themes to note from the excerpts above that pertain to the broader industry dynamics.

- Macro headwinds are present, but execs think this only provides an increased value proposition for cloud computing. Microsoft for instance highlighted the slow-down in old-school solutions and remarked on the need for ongoing digital transformation through Azure.

- Even seemingly macro cyclical software such as marketing-related software appears to be reasonably positioned in an innovation context. Other non-mission critical software such as Monday, effectively a user experience app on steroids, has done alright.

- Europe is relatively worse hit on software adoption compared to the US, likely from the war and resulting food and energy situations. This factor is only isolated to certain pockets of software.

- Platforms win, not individual apps in this economy. HubSpot and Monday, both highlighted their relative strength for multi-faceted use cases across a streamlined platform. If enterprises can do a lot of things through one product for and save costs, it’s good.

- Cloud transformation, is in fact, a way to save costs. And the ROI doesn’t accumulate after a few years – benefits are realized rapidly

I see the environment as excellent for pro-innovation software, particularly cloud companies. Use cases for these products are often remarkable, and the next-gen digital transformation companies are harbouring some lofty value propositions. To add, I cannot overstate the number of times the term “mission-critical” appeared across earnings transcripts, with great financial results to back them up. A Ctrl+F on the transcripts, and a good chance the most macro resilient businesses will be the ones that hark on about “mission critical”.

While the market participants are crying out for earnings right now, they should also note that growth is likely to continue, and it’s worth seeking out decent cash flow generation or even burn against a well-funded balance sheet. I say this because business execution is fine, and the growth pathways for continued market capture against long TAMs are still intact. For instance, Monday is burning cash moderately but has $800m on balance against a $400m sales run rate, compounding at 70{f5ac61d6de3ce41dbc84aacfdb352f5c66627c6ee4a1c88b0642321258bd5462}+ YoY. Some burn against this balance sheet is strategically intelligent in order to capture market faster.

Valuations Against History

Alright, so what about valuations? Those treasury yields are awfully high. Well, let’s put that into context.

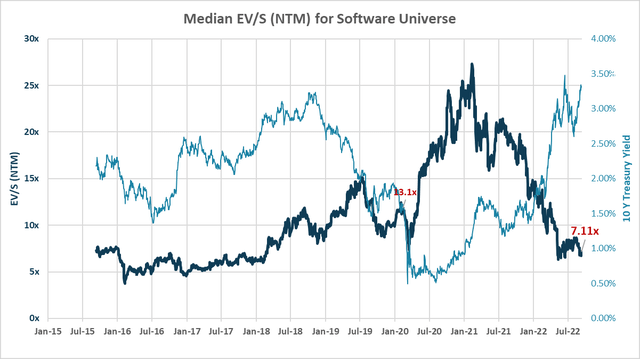

I crunched the data on EV/S (Next Twelve Months) from about 50 software stocks (both old and new) to find the universe’s median valuations against a 7-year time period. The 10Y yield is mapped in light blue. Note that I’ve excluded old slow giants like IBM and CSCO that don’t suit my target universe.

EV/S NTM Median multiples for a 50 stock universe (Author (data from Koyfin))

This chart singularly captures a lot of my reasoning for going long software now. Here are a few data inferences:

- The pre-pandemic peak came in 2019 at about 15x at a 2{f5ac61d6de3ce41dbc84aacfdb352f5c66627c6ee4a1c88b0642321258bd5462} yield and declining; right before the pandemic hit, the chart peaked once more at 13.1x

- With crushed yields and the raging bull run, we saw software medians reach as high as 25x forward metrics; mid-2021 saw inflation and yields on the horizon and late 2021 saw the onset of the macro we’re in right now

- 2015-2017 was fairly stable for multiples at a relatively low yield, the chart began moving up as cloud transformation stocks were on rapidly growing historical trajectories influencing the long-duration multiples taking averages up.

- We are now at 7.1x NTM EV/S on the universe, below the pandemic bottom, and back to 2017-2018 multiples.

The relationship between the treasuries and valuations charts seems logical. At the turn of 2018, we crossed the 7x threshold as yields. 2017 was considered by myself and many as a goldilocks period for valuations with growth, earnings, and stability post the Trump 2016 election proved favourable for the markets. As of today, the multiples have shot back to late 2017 or early 2018 numbers.

The question one should be asking is what is appropriate for today’s conditions. Should we get back to a 5x range? If yields head to 4.5{f5ac61d6de3ce41dbc84aacfdb352f5c66627c6ee4a1c88b0642321258bd5462} or more, that seems possible and a lot depends on inflation and stability. However, I’d also argue that the software landscape has radically changed since the mid-2010s. Today’s universe is littered with high-growth and hyper-growth stocks that show no signs of slowing down. Anchoring to a 2015 software environment is somewhat negligent of the improvement in business models and sales machines that drive today’s businesses. The EV/S forward multiples listed above tend to underestimate long-term high growth, only looking to the next twelve months.

To add, think of the following exercise: mark the chart above on New Year’s 2018, where multiples were around 7x, which is about the same as where they are now. Here is a list of software company returns since then that beat the markets from then to now:

- MongoDB (MDB): +818{f5ac61d6de3ce41dbc84aacfdb352f5c66627c6ee4a1c88b0642321258bd5462}

- Palo Alto Networks (PANW): +280{f5ac61d6de3ce41dbc84aacfdb352f5c66627c6ee4a1c88b0642321258bd5462}

- HubSpot (HUBS): +271{f5ac61d6de3ce41dbc84aacfdb352f5c66627c6ee4a1c88b0642321258bd5462}

- ServiceNow (NOW): +257{f5ac61d6de3ce41dbc84aacfdb352f5c66627c6ee4a1c88b0642321258bd5462}

- Microsoft (MSFT): +225{f5ac61d6de3ce41dbc84aacfdb352f5c66627c6ee4a1c88b0642321258bd5462}

- Twilio (TWLO): +187{f5ac61d6de3ce41dbc84aacfdb352f5c66627c6ee4a1c88b0642321258bd5462}

- Alteryx (AYX): +161{f5ac61d6de3ce41dbc84aacfdb352f5c66627c6ee4a1c88b0642321258bd5462}

All this compared to Nasdaq’s +89{f5ac61d6de3ce41dbc84aacfdb352f5c66627c6ee4a1c88b0642321258bd5462} and the S&P 500’s +52{f5ac61d6de3ce41dbc84aacfdb352f5c66627c6ee4a1c88b0642321258bd5462} over the same period. Now, this list certainly shows a cherry-picked survivorship bias and I don’t mean to paint the whole industry with it as some future expectation of returns. However, my point is that it is indeed possible to pick some innovative movers and have immense returns despite these flat valuation paradigms over a 5-year period. Funnily enough, even the now despised Twilio (TWLO) still outperformed the market. I don’t see a reason why there won’t be other names in software like these over the next five years when considering today’s industry dynamics and earnings call discussions across a host of mid/large-cap equities.

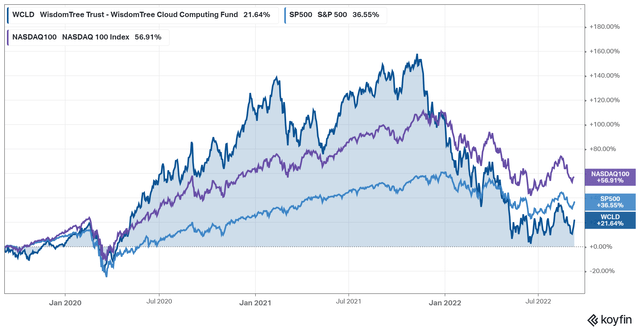

This trend of relative outperformance on multiples can be further explained by the following chart – which shows the total returns of the WisdomTree Cloud Computing ETF against the popular benchmarks.

WisdomTree Cloud ETF vs Benchmarks (Koyfin)

WCLD has underperformed the standard market benchmarks since its inception on 6th September 2019. However, one should also note that the ETF fought the median multiple compression from 11.9x on its first trading day to about 7.1x now. Had the valuation paradigm stayed at 11.9x, you’d have a geometric compounding of +67{f5ac61d6de3ce41dbc84aacfdb352f5c66627c6ee4a1c88b0642321258bd5462} more, theoretically pushing the +21.6{f5ac61d6de3ce41dbc84aacfdb352f5c66627c6ee4a1c88b0642321258bd5462} return shown above to about +100{f5ac61d6de3ce41dbc84aacfdb352f5c66627c6ee4a1c88b0642321258bd5462}, well above the Nasdaq & S&P.

There’s impressive relative outperformance to the multiple paradigms thanks to organic sales growth in the category.

At today’s 7x, despite the macro conditions and the current treasury yield, I think it’s time to get into software for those who aren’t in it already. We have come full circle, the damage is done, and while it may seem like you’re catching falling knives, the fundamentals paint a vastly different picture compared to the economy. Software isn’t a complement to an enterprise’s operations. It IS an enterprise’s operations – the backbone of every sizeable business. The transformation is far from over.

Even if the 7x range pushes downward, stocks that are organically growing will likely fight these multiples across time. Growth investing is time arbitrage after all.

Where Are The Hunting Grounds?

If one’s still concerned about macro, cybersecurity offers a macro resiliency like no other though I’d say the market has recognised and priced the players appropriately with high valuations. You can’t really go too wrong with big names like Microsoft which is more deeply integrated into the operations of modern enterprises than any other company. Amazon seems nice on account of AWS, countered by their e-commerce operations that don’t seem to ever make any real money.

However, if you are searching for the next MongoDB, HubSpot, or ServiceNow, you’ll have to work a little harder. In my observation, it is significantly more difficult to go from a $50B company to a $200B company than it is for a $5B company to go to a $20B company. For pure alpha, search in the mid-cap (<$10B) space and dig deep into emerging sub-technologies within the software category. Stellar management, product differentiation, and extreme quality engineering all help. Products and services should have value propositions that look like no-brainers from a customer’s standpoint. For instance, the infrastructure and warehousing cost savings from switching to Snowflake are frankly ridiculous for many pre-cloud or multi-cloud companies that have siloed up their data. There’s a reason why Snowflake boasts a 170{f5ac61d6de3ce41dbc84aacfdb352f5c66627c6ee4a1c88b0642321258bd5462} retention rate and 80{f5ac61d6de3ce41dbc84aacfdb352f5c66627c6ee4a1c88b0642321258bd5462} sales growth.

At The Abstract Portfolio, I’m used to hunting in the high-growth space where the long-term time-arbitrage is often highest but so is the risk of underperformance, capital loss, and uncertainty. It comes as no surprise that valuation multiples in the short term are also the highest here, but when properly contextualized, they can look very cheap against a 5-year forecast. Some emerging software spaces I’m keeping track of include:

- Software for Software: DevOps, Observability, and Automation Software

- Workflow Management Platforms

- New Marketing/Engagement Platforms

- Data Science and Artificial Intelligence, and anything really that touches data

- Cloud-based cybersecurity

- Israel-domiciled software – where engineering salaries don’t eat so much into bottom lines even though the product quality is excellent

- Businesses that can’t be compared to anything else – by differentiation, these companies have moats

In essence, there are areas of business that are less than a quarter of the way up their category’s S curve. That means they have a market opportunity several multiples higher than their current sales. Some operators in the above spaces have the chance to 5x or 10x their sales as they exponentially grow.

For more risk-averse investors, mature free cash flow generative companies with 20-40{f5ac61d6de3ce41dbc84aacfdb352f5c66627c6ee4a1c88b0642321258bd5462} growth seem like good spaces but I’d stress on identifying serious competitive advantages and some semblance of growth in addition to leadership. Tech is a “grow or die” sector and economies of scale work scarily well in software making the 3rd/4th best player in a category often die a drawn-out death or cheap buyout. If it’s too cheap, run the other way in case of a value trap. There are, of course, exceptions to these rules for sophisticated stock-pickers.

On the ETF side, SKYY, CLOU, and NASDAQ:WCLD appear to be decent candidates offering increasing levels of risk. If nothing else, Microsoft is a staple for any portfolio at a reasonable 26x Forward P/E at the moment if you’re buying and forgetting for the next 5 years.

Concluding Remarks

Marc Andreessen famously said: “Software is eating the world”. While many would have approached this high-valuation sector with apprehension in the face of weakening macro, high inflation, a recession, rising interest rates and yields, the actual fundamentals of several software businesses are demonstrating resilience. Periods of change and uncertainty boost the adoption of deflationary innovative technologies, even though this seems contradictory from a macro standpoint. I urge investors to look past the next 3-5 years.

It is entirely possible that inflation persists and treasury yields head higher, pushing the logical basis for valuing long-duration stocks lower. That said, the risk/reward is immensely in our favour as multiples have shot back to the late 2017 paradigm – when the category was smaller, slower, and not quite as exponential-growth-oriented. Despite the massive tech re-rating, cloud transformation remains critical along with many of its emerging sub-industries for the majority of enterprises out there. While I’m far from a macro investor, it’s worth noting that oil prices have peaked, and a counter-trend on the accelerating inflation is well underway. Food and energy, the two rather inelastic global supply chains have a tendency to re-orientate for supply to meet demand by the law of the free markets. It’s a matter of time.

At a time when the technology sector isn’t favoured by recent trends and institutional capital, it makes sense to be a contrarian given the data and fundamentals at hand. Software remains strong and you’re getting it at a rare discount today – making it the best time in the past several years to invest on the right side of this generational secular trend.