Alibaba, Tencent shares plummet as Xi Jinping tightens grip on power

Chinese technologies stocks tanked Monday soon after a political reshuffle in the world’s next-greatest overall economy tightened President Xi Jinping’s grip on electrical power with investors fearing this could be a unfavorable for non-public companies.

Tech giants Alibaba and Tencent shut down additional than 11{f5ac61d6de3ce41dbc84aacfdb352f5c66627c6ee4a1c88b0642321258bd5462} in Asia look for organization Baidu was 12{f5ac61d6de3ce41dbc84aacfdb352f5c66627c6ee4a1c88b0642321258bd5462} reduce though foods shipping business Meituan tanked extra than 14{f5ac61d6de3ce41dbc84aacfdb352f5c66627c6ee4a1c88b0642321258bd5462}.

The moves appear soon after Xi paved the way for an unparalleled third phrase as chief and packed the Politburo standing committee, the core circle of ability in the ruling Communist Occasion of China, with loyalists.

That will make it unlikely that any person would problem any “plan problems” that Xi can make which could hamper advancement of the tech sector, Xin Sunlight, senior lecturer in Chinese and East Asian enterprise at King’s University London, stated.

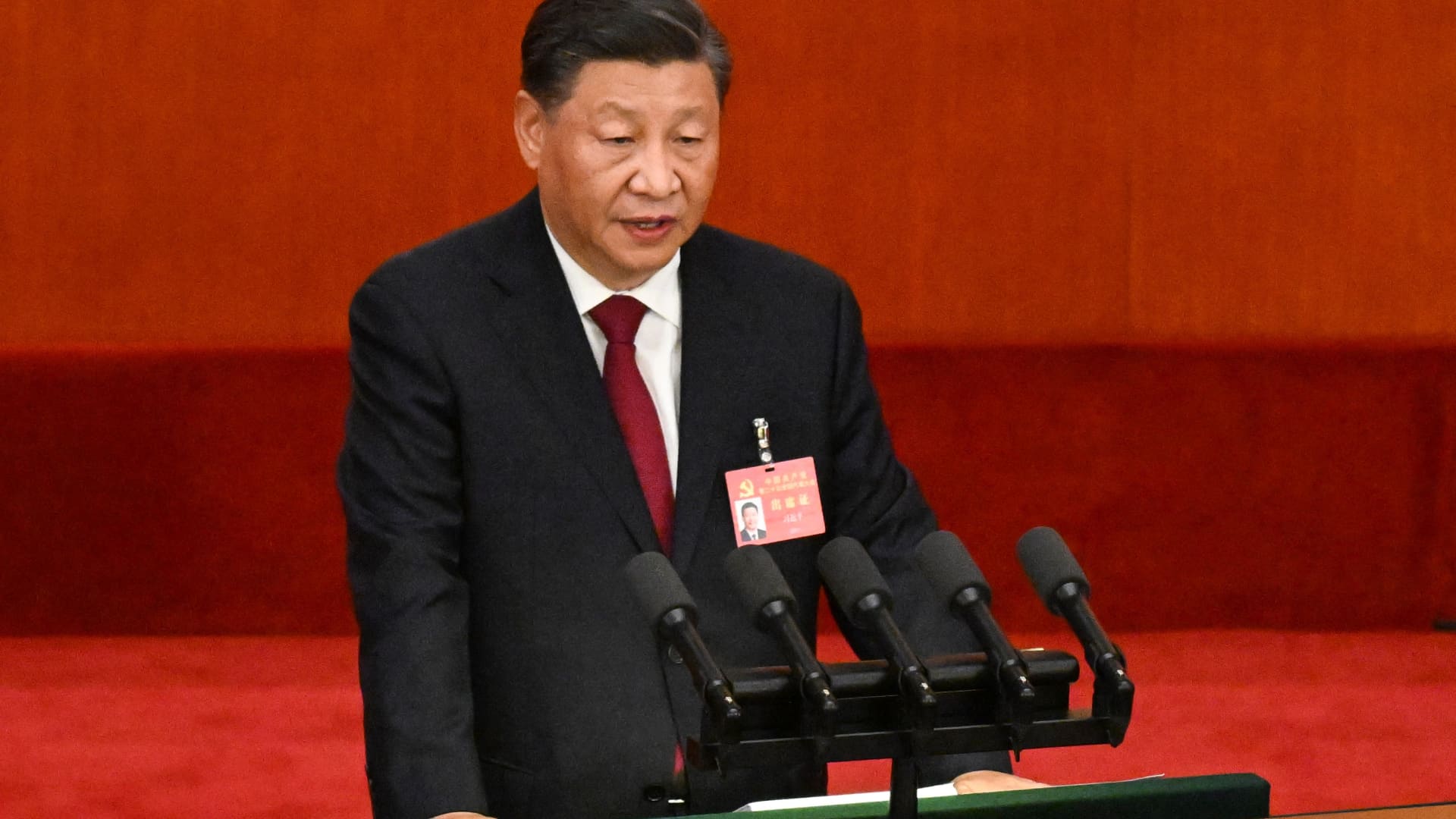

China’s President Xi Jinping talking at the opening session of the 20th Chinese Communist Party’s Congress at the Fantastic Corridor of the People today in Beijing on Oct. 16, 2022.

Noel Celis | AFP | Getty Photos

“Now that the new Politburo standing committee is packed with Xi’s very own picks and all those in rival factions … had been all out, it turns into very clear that no other political elite dares to problem his plan blunders or even deviate however slightly from his desired policy agenda, which of system around the previous several a long time has concentrated on favouring the state sector at the cost of the private one,” Sun told CNBC through e-mail.

“As a outcome, it is not likely for these insurance policies to be reversed or corrected, leading to an incredibly gloomy economic outlook.”

Below Xi’s management, China has executed policy that has tightened regulation on the tech sector in locations from facts safety to governing the way in which algorithms can be employed.

Meanwhile, Xi has trapped to the demanding “zero-Covid” coverage which has viewed cities, together with the mega economical hub of Shanghai, locked down this yr, even as most of the entire world has opened their economies.

These two procedures have contributed to billions of dollars becoming wiped off the value of Chinese tech giants and firms such as Tencent and Alibaba reporting their slowest expansion in history this yr.

“Tech shares have never ever been the ideal close friend of Xi and it is clear that the marketplace thinks that purge will go on,” Justin Tang, head of Asian exploration at United Very first Companions, explained to CNBC.

As portion of the management reshuffle in China, Li Qiang, bash secretary of Shanghai is predicted to be built leading subsequent yr. Li oversaw the lockdowns and zero-Covid method in Shanghai this 12 months. He has not served as vice leading marking a break with a lengthy-standing custom of the Communist Social gathering. Li will triumph outgoing Premier Li Keqiang, an official viewed as professional-business enterprise.

Solar said the new management is largely bash officials “who experienced limited to no prior practical experience or credible report in financial management,” marking a further cause traders are worried about the long run.

“A rigid political routine with restricted potential to appropriate a lot of of its plan blunders, the absence of able and expert economic policymakers, and developing geopolitical pitfalls, all underneath the leadership of a one person whose keep track of history has tested unfriendly towards the personal sector,” Sunshine mentioned, describing the unfavorable current market sentiment towards China tech shares.

On the other hand, not all analysts are anxious about additional regulatory tightening. In the past number of months, Beijing has taken much less spectacular regulatory action towards tech giants, prompting some commentators to suggest a softening stance from the governing administration towards web companies.

“Some of the coverage toward tech stocks has been softened,” Duncan Wrigley, chief China economist at Pantheon Macroeconomics, explained to CNBC’s “Avenue Signals Europe.”

“Overall, I imagine the stance of the management and the governments has develop into on harmony extra optimistic in excess of the last 12 months.”